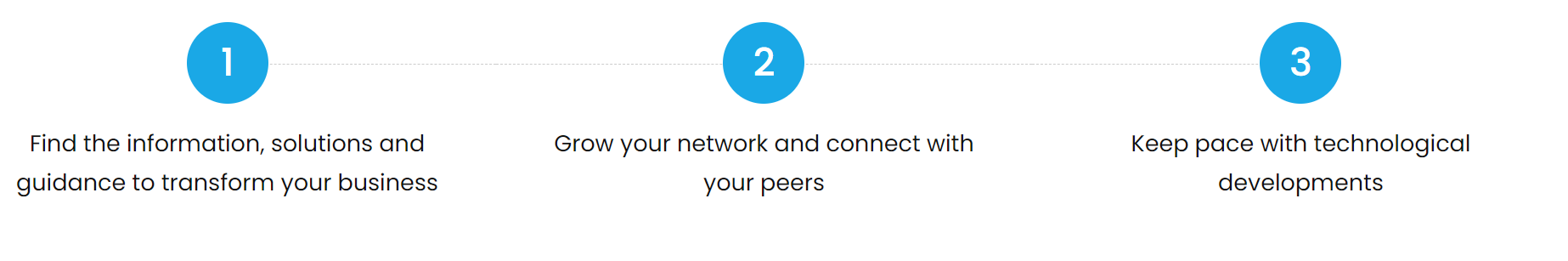

Design & Engineering Expo is made for designers and engineering professionals from all tiers of the supply chain looking to reduce costs, streamline and optimise future strategy.

With innovation at its heart, the 2-day, free to attend, event will allow attendees to uncover the latest technologies, learn from those breaking engineering boundaries and connect with suppliers to gain a competitive edge.

The goal of the Design Engineering Expo is to gather the most cutting-edge technological advancements and educational thought leaders so that engineers from all disciplines may thoroughly discuss and learn about issue solving from peers. Discover the most recent information on essential design engineering subjects, such as software, connectivity, IOT, VR, AI, data led design, CAD/CAM, prototyping, and much more.

It’s not just technical problems that are addressed at the event. Significant problems with supply chains, sustainability issues, a lack of skilled workers, and energy use will all be prominently included in the expert-led, case study-driven conference programme.

.png)